Contents

Introduction

Hello everyone,

Today, I will explain the framework of Japanese accounting standards.

Understanding the framework of accounting standards is beneficial for the following reasons:

– Grasping the intent and background of the standards to properly comprehend their content

– Organizing primary information on Japanese standards and knowing where to look for details when needed

Overview

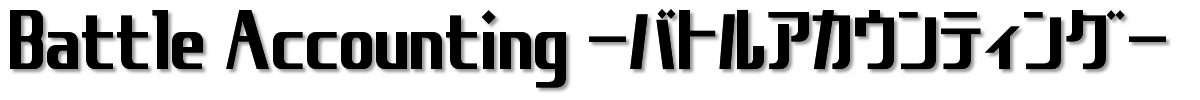

Japanese accounting standards have become somewhat patchwork, influenced by the “import” of foreign accounting practices during the accounting “Big Bang” in the late 1990s. It is helpful to understand Japanese accounting standards as comprising two main parts:

1. The Corporate Accounting Principles

2. The accounting standards introduced after the accounting “Big Bang”

The accounting “Big Bang” refers to the series of accounting reforms carried out in the late 1990s aimed at globalizing Japan’s accounting system. During this period, foreign accounting standards were rapidly “imported” and adopted in Japan.

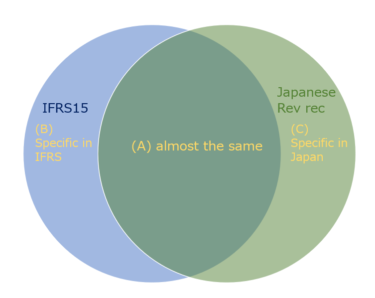

(1) Corporate Accounting Principles

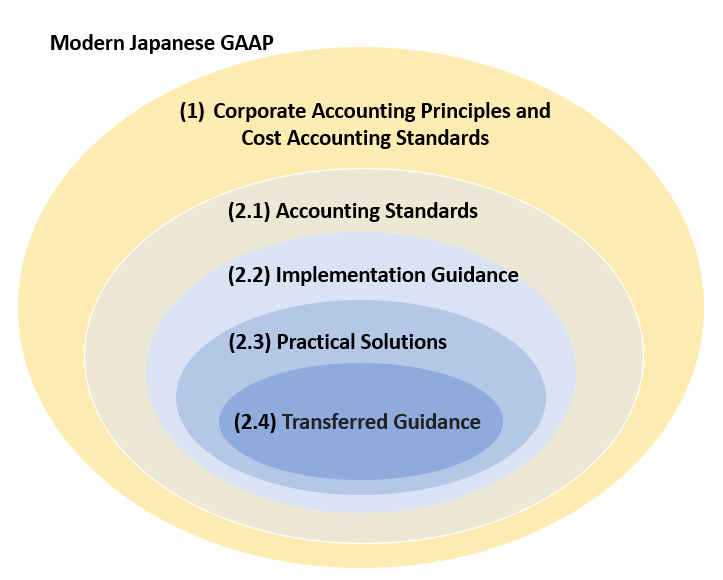

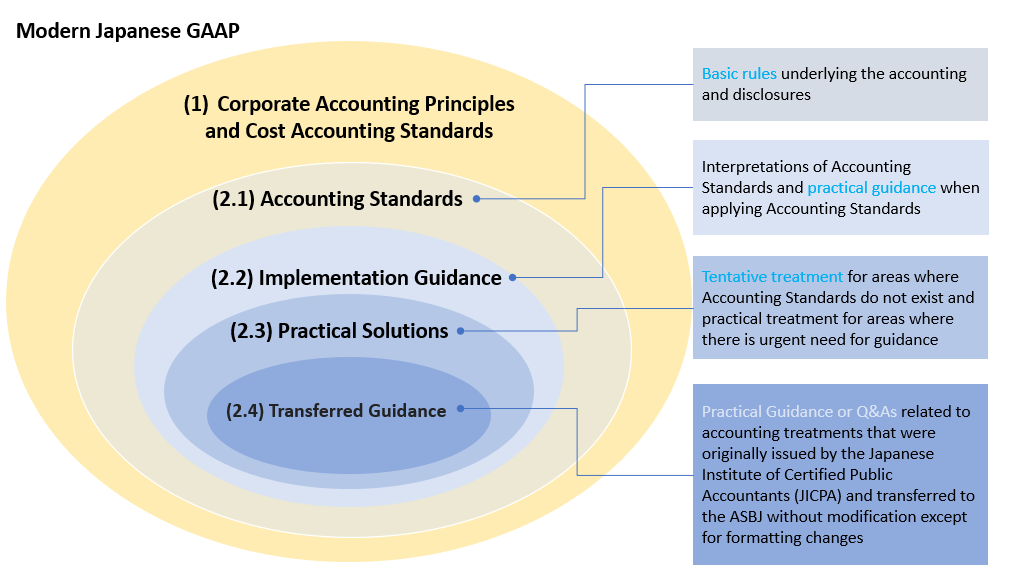

The framework can be illustrated as follows: Firstly, Japan has the Corporate Accounting Principles.

These include the Cost Accounting Standards, which focus on cost accounting and calculations (equivalent to IAS 2 and ASC 330).

Corporate Accounting Principles

Let me introduce the Corporate Accounting Principles.

After World War II, Japan developed its own “Corporate Accounting Principles,” which were the first comprehensive accounting standards in the country, establishing fundamental principles of accounting.

As stated in the preface, the Corporate Accounting Principles were created to improve and unify Japan’s accounting system with the aim of post-war economic reconstruction. This included promoting foreign investment, business rationalization, fair taxation, democratization of securities investment, and appropriate industrial financing.

The Corporate Accounting Principles have been respected and influential in the establishment, revision, and repeal of related laws and regulations, such as the Company Law, and tax laws.

While the Corporate Accounting Principles are somewhat similar to the conceptual framework under IFRS, they are not the same. For instance, the Corporate Accounting Principles do not define assets or revenues as components of financial statements.

Characteristics of Corporate Accounting Principles

I will explain the Corporate Accounting Principles in more detail on another occasion, but one key feature is that they are based on the so-called “revenue-expense (P&L) approach.”

This approach emphasizes the profit and loss statement (P&L) over the balance sheet (BS).

It focuses on calculating profit and loss without using the balance sheet’s difference to determine net income.

In my understanding, this difference in approach is clearly seen in the recognition criteria for provisions.

Consider the following journal entry:

(Dr.) Expense / (Cr.) Provision

Here, under IFRS, the recognition focuses on the credit side, i.e., the provision.

This means that if there is an obligation, it is recorded as a liability and an expense is recognized accordingly; if there is no obligation, no liability is recorded.

This approach focuses on the existence of obligations as balance sheet items.

However, the PL approach focuses on the debit side.

It considers the basis for recognizing an expense and records future expenses with a high probability of occurrence as liabilities, even if there is no current obligation, as long as these expenses are attributable to past events. As a result, Japanese standards require the recognition of provisions for repairs (*).

(*) A provision for repairs is an allowance set aside to cover future repair costs for tangible fixed assets owned by a company. In Japan, these are mainly recorded by industries such as oil refineries, steel manufacturers, shipping companies, and gas companies. They are often recorded to prepare for expenditures on regular inspections or large-scale equipment maintenance required by law.

(2) Individual Accounting Standards

Since the late 1990s, individual accounting standards have been added to the Corporate Accounting Principles.

Think of these new standards as supplements that strengthen the original principles. When individual accounting standards exist for a particular area, they take precedence.

The original Corporate Accounting Principles have not been replaced. For accounting issues not covered by the individual standards, one should refer back to the fundamental principles of the Corporate Accounting Principles.

These new standards are part of the globalization of accounting practices, incorporating and adapting elements from international standards and US GAAP.

The key point is that Japan does not just import these standards but also adapts them to fit its context without compromising their original intent. This adaptation is a strength of Japanese accounting.

There are four types of these new standards: (2.1) Accounting Standards and (2.2) Implementation Guidance, which are mandatory, and (2.3) Practical Solutions and (2.4) Transferred Guidance, which are not formally established as standards but are provided with practical considerations in mind. In practice, these also have substantial influence.

The ASBJ (Accounting Standards Board of Japan) website provides detailed explanations of these four types, as shown in this diagram.

Currently, the ASBJ (Accounting Standards Board of Japan) sets these standards, similar to the role of the FASB in the United States. Here is the link to the ASBJ website. Please select “English” to view the content.

The number of these new standards has grown significantly, far surpassing the volume of the Corporate Accounting Principles as of 2024. The ASBJ website provides detailed explanations of these standards, though the English descriptions are limited.

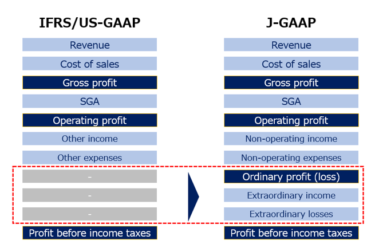

The contents of (2) are largely inspired by US GAAP and IFRS. For instance, the new revenue recognition standards, which have been mandatory since the beginning of fiscal years starting after April 1, 2021, are essentially equivalent to IFRS 15. However, as mentioned earlier, these standards have been adapted with Japan-specific elements throughout, which I will discuss further in the future.

What is referred to as Japanese standards?

Japanese standards, commonly known as “日本基準” (Nihon Kijun), comprise a combination of (1) and (2).

Therefore, when people refer to Japanese standards, they are generally referring to this amalgamation.

These standards have achieved international harmonization since the accounting “Big Bang,” and are recognized as accounting standards of quality equivalent to IFRS.

The Future of Japanese Standards

A debate suggests that we should reorganize the patchwork state of Japanese standards into a consistent system, similar to how past US-GAAP was structured into the current ASC system. ”

– However, I personally believe that this is not immediately necessary for the following reasons: ”

– We can resolve many issues in practice with the newly introduced accounting standards. ”

The adoption of IFRS by Japanese companies is increasing, and it is unlikely that foreign companies will adopt Japanese standards. Thus, the benefit of incurring costs for a system with a decreasing number of adopters is unclear.

– Companies using Japanese standards may find it challenging to allocate time for updating their accounting and auditing practices.

On the other hand, it is true that forcing new standards based on the asset and liability approach into the Japanese standards, which originally adopt the revenue and expense approach, has created logical inconsistencies. An example of this is the theoretical understanding of provisions.

Regarding the theory of provisions, there is now a trend suggesting that “obligations are necessary” even under Japanese standards. However, since such wording is not found in the standards, widespread interpretation in this manner can lead to confusion.

In any case, I believe that Japanese standards will undergo a fundamental reorganization in the long term.