Contents

Introduction

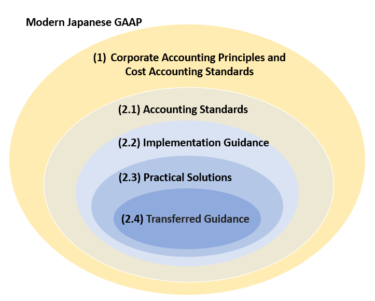

For this time, please let me introduce the main presentation features of P&L under Japanese accounting standards.

1. The presentation of a segmented/categorized profit and loss, such as Operating profit (loss) or Ordinary profit (loss)

2. Presence of extraordinary gains and losses

3. Disclosure of major components of SGA (Selling, General, and Administrative expenses)

These points should be remembered by those who view the P&L of Japanese companies and those who prepare financial statements in accordance with Japanese GAAP.

P&L Features 1

1. The presentation of a segmented/categorized profit and loss, such as Operating profit (loss) or Ordinary profit (loss)

Japanese GAAP designates and specifies a segmented/categorized profit and loss, which the entities should disclose as follows.

– Gross profit

– Operating profit (loss)

– Ordinary profit (loss)

– Profit (loss) before income taxes

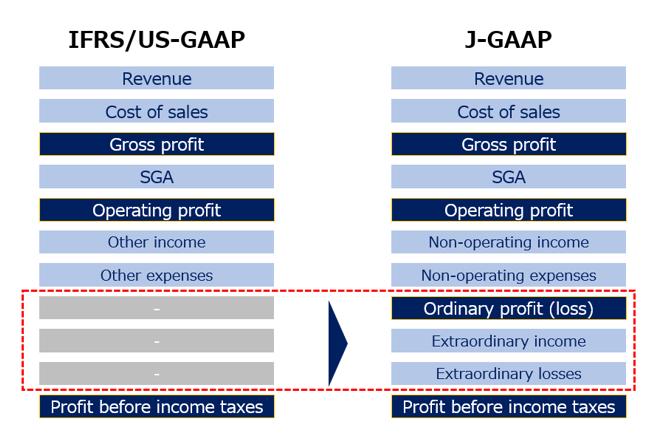

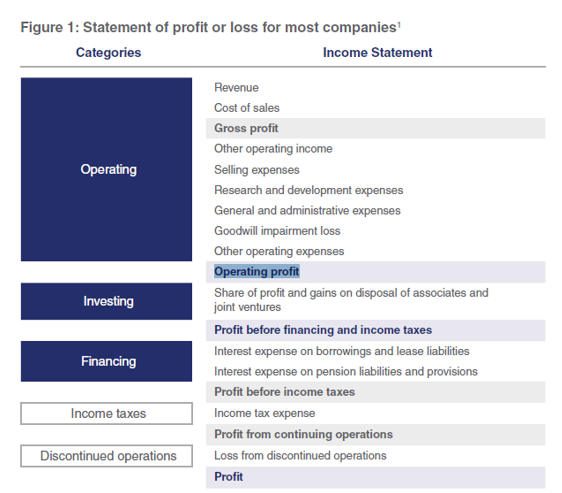

The following diagram shows the profit and loss for each, between J-GAAP and IFRS/USGAAP.

There are two key points.

1. Always presented Operating income (loss) and Ordinary income (loss)

The first point is that the entities always present operating income (loss) and ordinary income (loss) under J-GAAP.

This will make it easier for readers/users to compare P&L, particularly with other companies in the same industry.

Non-operating income usually includes interest and dividends received, while non-operating expenses include financial expenses such as interest paid. They also include gains and losses that are not directly related to the core business, such as foreign exchange gains and losses.

Specific examples are as follows.

Non-operating income

– Interest income

– Interest on securities

– Dividend income

– Share of profit of entities accounted for using equity method

– Foreign exchange gains

– Gain on valuation of derivatives

– Gain on valuation of interest rate swaps

– Interest on loans receivable

These are not results from the core business but from debt or equity investments and changes in the index, and as such, are not included in operating income (loss).

This type of segregation will ensure that the meaning of operating income/loss represents the core business result and outcome.

2. No choice

The second point is that companies are required to disclose such gains and losses, and there is no room for choice.

This requirement has the advantage of efficiency for corporate disclosure decisions.

“If disclosure of operating and ordinary income were to be made optional, issuers would be required to exercise prudent judgment.

We can imagine the meetings that would be held to determine what type of profit to disclose, and that would need time to close the meeting.

However, if the disclosure of categorized income/loss is mandatory, such time-consuming decisions will not be necessary.”

“As a further consequence, mandatory disclosure of categorized gains and losses would also benefit users of financial statements.

If the disclosure remains voluntary, it could happen, for example, that Company A discloses its ordinary income (loss), but Company B does not. This would make it difficult for the user, the investor, to make adjustments for comparison or, at worst, to make a complete comparison.”

The Japanese standard thus has disclosure requirements that can save costs for both the FS preparer and the investor.

In addition, IFRS 18 will amend the rules and introduce the disclosure of categorized gains and losses.

IFRS 18 requires a company:

• to classify income and expenses into operating, investing and financing (dark blue in Figure 1) categories in the statement of profit or loss—plus income taxes and discontinued operations; and

• to present two new defined subtotals—operating profit and profit before financing and income taxes.”

Please see this link for the further infoamation.

Under Japanese GAAP, comparative convenience between companies was already achieved prior to the introduction of IFRS18. This is because Local standards, rather than international standards, allow rules to be added at the convenience of one’s own country.

However, it would be more convenient for everyone to have mandatory disclosure of categorized profits, regardless of whether it is in one’s own country or another.

P&L Features 2

In J-GAAP, the item “extraordinary income” and “extraordinary loss” are listed in the P&L.

This is not found in IFRS and is rarely found in the US, but it frequently appears in J GAAP.

So, what kinds of things qualify as extraordinary gains or losses?

There are two key factors: first, it must be extraordinary and unusual, and second, it must be large in amount.

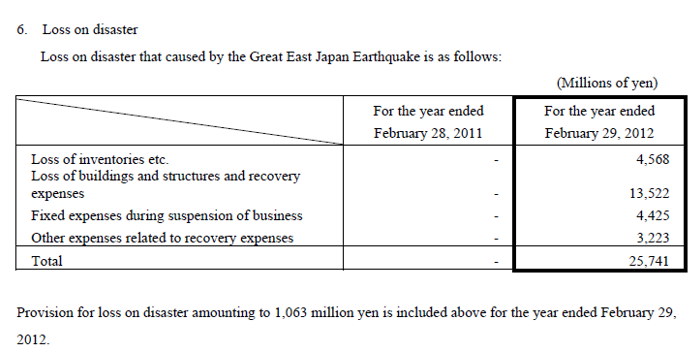

An obvious example is a loss due to a disaster.

Since disasters do not usually occur every fiscal year, and once they do, they profoundly impact a company, and they frequently fulfill these two requirements.

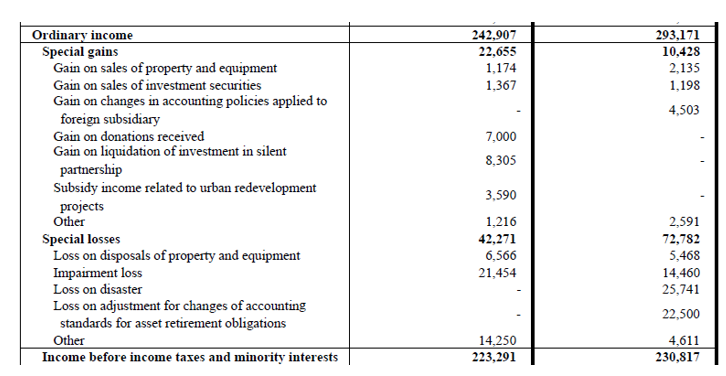

For example, please look at the following partial P&L. Below is Seven & I Holdings’ P&L for the fiscal year ended February 2012, when the Great East Japan Earthquake occurred (source from the Kessan Tanshin *1 in English).

*1 A “Kessan Tanshin” is a financial report published by Japanese companies that are listed on stock exchanges without an audit report. It is an important document that provides a summary of the company’s financial performance for a specific period, usually quarterly or annually.

“Loss on disaster” is disclosed as Special lossesa under Ordinary income.

In addition, as shown below, significant extraordinary gains and losses are often explained in depth in the footnote.

We Japanese are accustomed to this extraordinary profit/loss style, so we can look at the P&L and instantly know what items are in an extraordinary profit/loss. Not to mention that it is very easy to make comparisons with other companies.

In Japanese accounting and auditing practice, there is daily debate/discussion over the disclosure of these extraordinary gains and losses.

In other words, the issuer may have an incentive to include it in operating income if it is a profit and to include it in extraordinary losses if it is a loss (not to reduce operating income).

However, the entity must objectively determine whether disclosure as extraordinary gains or losses is appropriate.

It is not uncommon for a company to have heated discussions with its auditors about the account’s extraordinary or unusual nature, its consistency with past practice, the amount’s materiality, and how the account should be named.

Users of the financial statements can use the information with confidence, knowing that extraordinary gains and losses are disclosed through these discussions.

In addition, social conditions may dictate to companies individually what their extraordinary gains and losses should be.

For example, there was a time when a new type of coronavirus raged and affected the performance of companies. The “Audit Consideration related to COVID-19 Part 4” issued by the JICPA drew the following line at that time.

At that time, the government and local governments issued requests, statements, and others to prevent the spread of new coronavirus infections. Under these statements, the Japanese society decided that the following expenses, if incurred, would be recognized as extraordinary items.

– The fixed costs incurred while the Company suspends the operation of a store or cancels an event and the direct costs incurred in preparing for and canceling such an event.

– Impact on costs caused by extraordinary decline of factory operation rate due to extremely low capacity utilization when a plant shuts down or curtails operations

Because these are also extraordinary, significant, and unusual, they are not included in operating income/loss under Japanese GAAP. This is due to the view that it is appropriate to analyze these effects separately from a company’s normal earning capacity.

P&L Features 3

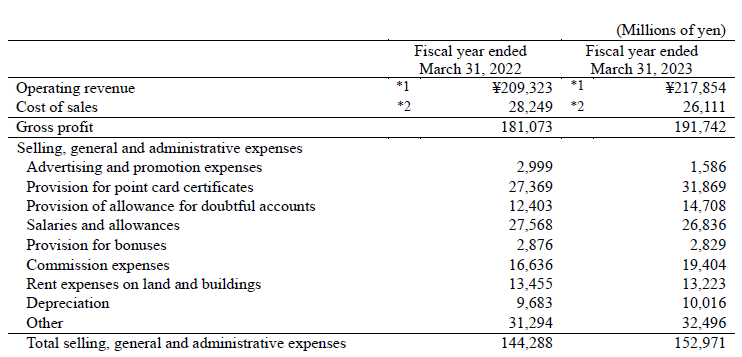

Japanese GAAP also requires disclosure of the SGA, but it also differs in that it requires disclosure of the main breakdown of the SGA.

In other words, unlike IFRS and US-GAAP, the entity should disclose the primary breakdown of SGA under Japanese GAAP.

The following is an example from MARUI CO., LTD. regarding this case. Since the breakdown of SGA contains significant information in evaluating the results of operating income, it is clear that clearly stating the primary breakdown of SGA is more conducive to financial analysis than not doing it.

Furthermore, this will make it easier to make comparisons with other companies as the rules are established.